|

|

|

|

|

|

| 中文 |

| اللغة العربية |

| President’s Invitation | Council’s Message | Committees Message |

|

Arab Health Tips |

Shariah Compliance does attract Muslim Investment Growing international interest in the vast investment wealth of the Moslem world where financial affairs are guided by Shariah law and principles laid down in the Quran could open a significant niche market for Hong Kong’s business sector. Worldwide Islamic Capital is at well over $1 Trillion and Islamic-held assets are estimated to be worth more than $275 billion much of which is managed by Middle East based advisers of US and European banks which comply with Shariah. Improve your company’s prospects for projects, finance and partnership by getting your Establishment's Shariah Compliance Certificate. |

| Upcoming

events ARAB CHEMICAL AND PETROCHEMICAL INDUSTRIES FORUM (28 April - 29 April 2008) Damascus LIBYA OIL & GAS (10 May - 13 May, 2008) Tripoli |

|

| Quote Advice is what we ask for when we already know the answer but wish we didn't. (Erica Jong) |

Consultancy A network of quality assured consultants at your disposal, no matter what your business need |

| International

Trade Our Trade Solutions can provide you with a range of information and advisory services leads. Talk to our advisors for more details on; • Trade Consultancy • Skills and Approach • Business Education • Develop New Markets • New Business Contacts |

Business

Solutions Reminders Our Business Support Solutions work in close partnership with other Chambers of Commerce & Industry and can be a vital asset to your business, whatever your size, sector or stage of development. As part of the Business Solutions, we offer an extensive range of services, covering business promotion, training and recruitment. To find out more about what our Business Solutions can offer contact us. |

• Networking

• Supporting your Network • Accessing Tenders • Selling More • Establishing New Agents • Sourcing New Potentials • Presenting Seminars |

Reminders A typical dissatisfied customer will tell eight to ten people about their problem. Seven to ten complaining customers will do business with you again if you resolve the complaint in their favor. If you resolve a complaint on the spot, 95% will continue to do business with you. Of those customers you lose, 68% leave because of attitude of indifference on the part of the company or a specific individual. In summary, customer satisfaction equals success. The next time your long-time patron has a suggestion or a complaint, listen and remember. |

|

|

Commerce UAE Cement crisis looms UAE suppliers of ready-mix concrete are struggling to keep up with demand with the risk that construction projects may be delayed further, cement companies and contractors said on Tuesday. "We are already feeling the pinch and, if this situation continues, we are bound to see more delays in delivery of projects,"said Ibrahim El-Hamadi, executive director of Arabtec Construction, reported Emirates Business 24/7. Arabtec Construction is a unit Dubai-based Arabtec Holding, the UAE's largest listed construction firm. In the past week, cement prices have surged 25% as higher oil prices make fuel needed to make the product more expensive, the newspaper said. "We need cement to do our work, but since yesterday we have failed to get any, meaning that our production has been zero for two days," said the managing director of a ready-mix company, who declined to be identified, according to the newspaper. The managing director of another ready-mix company told Emirates Business its daily concrete production had dropped to 40% of capacity in the past two weeks and was likely to slide further. Cement and steel price increases in the UAE are expected to reach the 20% mark this month, according to some industry experts. Cement and Steel prices set for further increase |

|

Infrastructure $200 million oil storage facility slated for Techno Park Dubai Multi Commodities Centre (DMCC), Star Energy Resources and Tropicana Trading DMCC today announced the signing of a Framework Agreement to build a world-class oil products storage facility at Techno Park in Dubai. The proposed oil storage terminal will have an initial capacity of 570,000m³ and involve an estimated investment cost of around US$200 million. The facility will store a wide range of oil products, including gasoline, diesel, jet fuel and fuel oil, as well as offering complementary services such as blending. Located near the upcoming Dubai World Central - Al Maktoum International Airport, the storage infrastructure facility is expected to service the new airport via a pipeline directly linking the two facilities. In addition, two new oil tanker berths will be built at the western breakwater of Jebel Ali port for easy supplier access, with the capacity to accommodate tankers of up to 80,000 tonnes. “Ensuring adequate oil storage facilities is crucial for enhancing Dubai's role as the Middle East's leading oil products trading hub and for accommodating the rapid growth of Dubai's own oil products demand, particularly its need to support a burgeoning civil aviation sector," said DMCC executive chairman Ahmed Bin Sulayem. |

|

Energy

"For a country like Saudi Arabia... one of the most important sources of energy to look at and

to develop is solar energy," Ali Al-Nuaimi told French oil newsletter Petrostrategies.  Qatar eyes world's biggest solar complex Qatar is considering building one of the world's largest solar power complexes to help meet demand,

which could increase four-fold over the next 30 years, the Middle East Economic Digest (MEED) reported. Floating islands off the UAE coast could convert solar energy into electricity or hydrogen on a massive scale, the head of project under development in Ras Al Khaimah said on Wednesday. The emirate has pledged $5 million to build a prototype for the huge solar panel-covered structures which could transform the development and utilisation of solar energy, said Thomas Hinderling, CEO of the Swiss Centre for Electronics and Microtechnology (CSEM). The project will “gather a great deal of experience in a technology that is of enormous importance for the future energy supply of our planet”, Hinderling said. With a 100-metre diameter, the prototype is a tenth of the size of the final product. It will include a thermal energy reservoir and will be able to supply energy 24 hours a day. Peak output will be one megawatt, with medium output estimated at 250 kilowatts. The floating structure will enable the island to be easily turned to always face the sun, generating maximum power, Hinderling said. To avoid having to connect the island to the mainland, the electricity could also be used to make hydrogen that could then be stored on the island before being shipped elsewhere. "A floating infrastructure means a very low construction coast, There are no support structures to build", Hinderling said. The facility depends on a number of conditions. There must be around 350 days a year of sunshine and it needs to sit somewhere between the tropics, near the equator, for optimal performance, making the coastal region of the UAE the ideal testing ground. According to Hinderling, the biggest hurdle to the project will be the construction of the island itself. It is still unknown how the infrastructure will react in high winds, he said, adding, "We have done simulations that have not revealed any problems, but it is not until we have tested in the real world that we will know if it works." Environment Qatar public transport goes green Qatar is beefing up its green credentials with the development of the region’s first environmentally-friendly public transport system, it was reported on Monday. The "GCC summit, which consists of GCC countries" has the authority to change the currency peg, Sultan Bin Nasser Al Suwaidi said yesterday in Seoul. The six-member group holds a summit on December 3-4 in Qatar and Al Suwaidi said he did not know whether currencies were on the agenda. Al Suwaidi said yesterday that the falling dollar will trigger a review of the dirham's 30-year-old peg and his country was considering linking the dirham to a basket of currencies. Inflation rose to a record 9.3 per cent in the UAE last year, and has hit records in Saudi Arabia, Qatar, Oman and Kuwait this year. Al Suwaidi said he is "not aware yet" if any decision will be made on depegging from the dollar at the meeting. "I don't know about the agenda of the supreme council summit," he said on Friday.Markets LSE names Qatar as Gulf partner The London Stock Exchange has confirmed Qatar as its main partner to develop a regional financial market, it was reported on Monday. Under a deal to be announced soon, LSE will supply services and technology to develop the Doha Stock Market, reported Emirates Business 24/7.  According to LSE officials, a decision has already been made, and an announcement could come within weeks, the business daily said. Qatar owns 15% of the LSE through the Qatar Investment Authority, its $60 billion sovereign wealth fund. The QIA said in January it planned to use its stake in the LSE to develop its own capital markets. A deal with Dubai had been ruled out due to conflict of interest despite Borse Dubai holding a 20% stake in LSE, said CEO Clara Furse. Borse Dubai and Nasdaq closed a deal last month to buy Nordic and Baltic stock exchange OMX. Under the deal Borse Dubai took Nasdaq’s stake in the LSE, while Nasdaq agreed to take a 33% stake in the DIFX. “We having nothing against Dubai, but they must believe Nasdaq can do a better job for them. They have chosen to ally themselves with Nasdaq, which is a major competitor to LSE. They cannot do a deal with both of us” an LSE executive told Emirates Business. Borse Dubai said in February it would consider selling a stake in the LSE to Qatar, but had not received any approaches and was unlikely to sell any stake in the short term. Islamic Finance Qatar to launch $1bn Islamic fund Qatar Islamic Bank (QIB) said on Monday it intends to partner with investment banks QInvest and Silver Leaf Capital (SLC) to establish a $1 billion Islamic private equity fund. QIB said the Dhow Gulf Opportunities Fund will be structured in line with the international private equity industry standards and will be Shariah-compliant. A memorandum of understanding (MOU) between the three companies to develop the fund was signed in London on February 5, outlining intentions to establish the fund. The banks said the fund would seek to attract international capital to the region in general, specifically Qatar, and focus on investments in sectors from telecom to environmental recycling technologies, media, oil and gas and infrastructure. The fund will be managed by Dhow Investors Advisor (DIA). “Our objective is to invest in diverse sectors that will allow technology migration and transfer of know - how to Qatar,” Salah Jaidah, chief executive of QIB, said in a statement, adding that “we already have in the pipeline about $300 million of investment opportunities that Dhow Investors Advisor (DIA) is evaluating”. QIB will act as anchor investor in the project and also as lead distribution agent in Qatar and senior distribution agent outside Qatar using QIB’s affiliates in the UK, Lebanon and Malaysia. Abdulatif Almeer, CEO of QInvest, stressed his confidence in the project, citing the extensive experience of the investment team and strong global contact base. Qatar has sought to establish itself as a financial powerhouse in the Gulf region with the Qatar Financial Centre (QFC), located in Doha, at the centre of the effort. The fund initiative from QIB, QInvest and DIA is subject to Qatar Central Bank and QFC regulatory approvals. QNB to set up Islamic financial services firm Qatar National Bank (QNB) said on Sunday it had agreed with Kuwaiti partners to set up an Islamic financial services firm to tap growing demand for Shariah compliant financing in the Gulf Arab region. Qatar's biggest bank by market value will own 30% of Kuwaiti-Qatari Company for Leasing and Investment, which will provide Islamic financial services to Gulf countries, the lender said in a statement on the Doha bourse website, without giving details. Qatar National did not name its Kuwaiti partners in the 24 million dinar ($88.46 million) firm, which will comply with Islam's ban on purchasing assets that pay interest or earn profits from industries related to alcohol, gambling or pork processing, among others. Qatar National's Islamic banking operations - which contributed 148 million riyals to its profit last year - could climb by as much as 80% in 2008, the Chief Financial Officer (CFO) Ramzi Talat Mari told newswire Reuters in January. Like other lenders in the world's biggest oil-exporting region, Qatar National has been expanding abroad as competition in its home market intensifies. The lender said in September it had agreed with partners to set up a bank in Syria and revealed earlier this month that it took over the Qatar government's 50% stake in Tunisian-Qatari Bank. In July, Qatar National had taken over the government's shares in Jordan's second-biggest lender. |

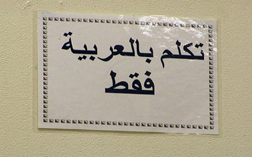

Transport Etihad opens up China to Oman-based air travellers Air links between Oman and China are set to improve with the launch by Etihad Airways of a new, four-flights-per-week, service from its Abu Dhabi home-base to Beijing on 30 March 2008. To celebrate its first flights to China, and entice Oman-based customers to visit the Chinese capital, Etihad has launched a new promotional campaign with air fares starting from OMR188 in economy class and OMR 588 in business class. Speaking at a media event in Muscat on Tuesday, Jaffar Jumar, Etihad Airways' country manager Oman, said: "Beijing has established itself as one of the world's fastest growing and most popular destinations and we are extremely proud to be "We anticipate tremendous demand for this new Etihad service from our customers living in Oman which includes the growing Chinese community in Muscat."  Beijing will be Etihad's eighth destination in its rapidly expanding flight network in the Asia-Pacific region which already includes services to Brisbane, Sydney, Manila, Jakarta, Kuala Lumpur, Singapore and Bangkok. Mr Jaffar added: "There is a huge appetite from business and leisure travellers for flights to Beijing, especially ahead of the 2008 Olympic Games, and we look forward to bringing Oman and China closer together." The media event in Muscat also marked the two year anniversary of Etihad Airways in Oman. During this time Etihad has increased its flights to Abu Dhabi from daily to three times a day, connecting with the airline's global network of 45 destinations. Etihad will operate a two class Airbus A330-200 from Abu Dhabi to Beijing which is configured to carry 262 passengers with 22 in business class and 240 in economy class. Etihad's services to the Chinese capital will operate every Monday, Wednesday, Friday and Sunday with flight EY888 departing from Abu Dhabi at 11.45pm and arriving in the Chinese capital at 11.30am the next day. Return flight EY889 departs from Beijing every Monday, Tuesday, Thursday and Saturday at 7.10pm arriving in Abu Dhabi at 00.20am the next day. Qatar Airways announces summer 2008 expansion Qatar Airways today unveiled its summer 2008 expansion programme with capacity increases to numerous destinations across its global network and the launch of its fourth destination in China - the southern industrial port city of Guangzhou. A dozen cities will see more flights added to existing frequencies to offer passengers greater choice. Guangzhou becomes Qatar Airways' first route launch of the year on March 31 and the airline is preparing for its third US destination - Houston beginning on November 10. From London Heathrow and Milan in Europe, to Johannesburg and Lagos in Africa, to Seoul and Islamabad in Asia, together with further expansion on the New York (Newark) route, Qatar Airways has a busy year ahead.  Expansion highlights include an extra daily flight to London Heathrow taking capacity to Britain's busiest airport up to four flights a day; Beirut rising to double daily flights; and both Johannesburg and Seoul going up to daily. Between Qatar and Germany, Qatar Airways operates 24 flights a week - 10 to Frankfurt and daily to both Berlin and Munich. The airline looks forward to opening up further destinations in Germany over the next few years as part of its growth strategy to widen its presence in the German market. Addressing media at a press conference on the opening day of ITB - the world's biggest travel fair taking place in Berlin this week - Qatar Airways Chief Executive Officer Akbar Al Baker said the airline was gearing up for yet another exciting year of expansion. "Qatar Airways is committed to a growth strategy that will see our fleet of 62 aircraft increase to 70 by the end of the year and almost double to 110 planes by 2013," he said. "Our global reach of 81 destinations will extend to more than 100 cities by the turn of the decade and coinciding with the opening of the New Doha International Airport. "As we take delivery of more aircraft, we are able to consolidate our position by increasing frequency on existing routes and introducing new routes to give passengers greater choice." Al Baker explained that in line with the growth strategy, 2008 will see new routes launched to Guangzhou and Houston, together with capacity increases to a dozen cities starting from the end of March, which signals the start of the summer flying season. The addition of Guangzhou strengthens Qatar Airways' China network, where it already flies to Beijing, Shanghai and Hong Kong with a total of 16 flights a week. Guangzhou takes the airline's capacity into China up to 20 flights a week, rising to 21 with the addition of a fifth weekly service to Guangzhou from May 1. Guangzhou and nearby Hong Kong provide excellent twin-centre options. With excellent connections from Europe, Middle East and Africa to and from Guangzhou, Qatar Airways is boosting its presence in one of the fastest growing economies of the world. The new services will provide a strong sporting link as Doha hosted the biggest ever Asian Games in 2006, while Guangzhou is set to host the next Asian Games sporting extravaganza in 2010. Added Al Baker: "Looking to the future, we have more than 200 outstanding orders for brand new aircraft, which include 80 of Airbus' next generation A350s and 60 Boeing 787s. Our aircraft delivery schedules will increase to at least one a month from July 2008. And in October 2008, we will take delivery of the first of our Boeing 777-200 Long Range aircraft. "The Boeing 777-200LRs will be capable of flying up to 17 hours non-stop and Qatar Airways' Doha hub is geographically well positioned to operate to virtually any point in the world with this new generation aircraft. Qatar Airways is pleased to announce that our first Boeing 777LR aircraft will be deployed when we launch Doha - Houston services on November 10. "The Doha - Houston route will be one of the world's longest flights of around 17 hours. We look forward to offering our customers with the ultimate levels of comfort and service with our brand new Boeing 777-200LRs on the route." The Houston service will initially be operated three-times-a-week, rising to daily services a few weeks later in December 2008. Emirates notches up fourth Chinese route Emirates announced its latest destination, with Chinese city Guangzhou joining the airline's expanding network. On July 1, the Dubai-based carrier will initially launch four non-stop weekly services to the ancient city. All flights will be carried out using Airbus A330-200s with two class configurations. The service then increases to daily flights from December 1, using A340-300 and A330-200 aircraft. European passengers and US customers travelling from Houston and New York will be able to book connecting flights to Guangzhou. This service will also be available to Middle East and African passengers. The new route is Emirates fourth Chinese city, following Shanghai, Beijing and Hong Kong. HH Sheikh Ahmed bin Saeed Al-Maktoum, Emirates' chairman and chief executive, believes the city is crucial to expanding the airline's Asian operations. He added: "Guangzhou is a vital link in our strategic plans for both China and the Asia-Pacific region. The city has been on our radar for some time as it is the heartbeat of the Guangdong Province and hums with its political, socio-economic, scientific, educational and cultural life. Guangzhou serves as an air travel hub for Guangdong and the South China provinces, which significantly expands our span and reach. Emirates had interests in Guangzhou before announcing this latest route. Through its subsidiary Changi International Airport Services, the airline holds a 20% stake in ground handling services provider Guangzhou Baiyun International Airport Handling Co. Guangzhou is the third largest air travel hub in China and capital of the Guangdong province. Dubbed the "factory of the world", the Guangdong province has the largest GDP and highest value of exports, attracting huge foreign investment. Gulf Air to launch non-stop flights to China Shanghai to become the 41st destination in airline's network. Gulf Air, the national carrier for Bahrain, will introduce non-stop Shanghai service as part of the airline's growth strategy. The four times a week service will commence on 16th June 2008 and operate from Bahrain to take advantage of two-way connectivity to many Gulf and major Middle East markets. The route will be operated by using an Airbus A340-300, offering first, business and economy class service. The service will be later upgraded to daily flights, effective winter schedule 2008. "China is one of the fastest growing economies in the world and for Gulf Air it is strategically important that we launch into this booming market this year," says Gulf Air Chief Executive Officer Björn Näf. "We will be offering our sky beds and other award-winning in-flight services, such as the Sky Nanny service, to this new route and we are looking at other international destinations to expand our network as part of our strategy to become the airline of choice." Gulf Air's Vice President Network Hashim Mahmood says the Bahrain-Shanghai route and the planned schedule to the destination will be the, "most attractive in the region." "The two-way traffic between the region and China is growing tremendously and our revamped network offers better connection times, which will be an added advantage for Gulf Air customers." Gulf Air launched a new revamped network in July 2007, which offers more than more than 400 flights per week in the region.  Life UAE makes Arabic official tongue Monday, 10 March 2008 Arabic has been confirmed as the official language of UAE federal authorities, the government announced on Sunday. The move has been lauded by commentators who have campaigned to combat the growing use of English in government departments. Ebtisam Al-Kitbi, professor of political science at UAE University told UAE daily Gulf News the decision would “enhance the presence of Arab speaking people in the labour market and restore the national identity”.  “To my knowledge, there is no nation that allows an invasion of foreign languages in government institutions the way we did in the UAE. The move will correct the imbalance,” she said. “People [in other countries] use foreign languages, but you will never see them in the workplace other than their national languages. English is widely used in the government in the UAE and this is unacceptable,” she added. |

| PROMOTING COMMON GOALS Join Us Support us Advertise with us |

|

Copyright © 2007 - 2022 ARABCCI, All rights reserved | جميع الحقوق محفوظة | 不得轉載 | Disclaimer | Site Map