|

|

|

|

|

|

| 中文 |

| اللغة العربية |

Petroleum |

Petroleum (from Greek petra – rock and elaion – oil or Latin oleum – oil) or crude oil, sometimes colloquially called black gold or "Texas Tea", is a thick, dark brown or greenish liquid. Petroleum exists in the upper strata of some areas of the Earth's crust. It consists of a complex mixture of various hydrocarbons, largely of the alkane series, but may vary much in appearance and composition. Petroleum is used mostly, by volume, for producing fuel oil and gasoline (or petrol), both important "primary energy" sources (IEA Key World Energy Statistics). Petroleum is also the raw material for many chemical products, including solvents, fertilizers, pesticides, and plastics.

Formation

Most geologists view crude oil, like coal and natural gas, as the product of compression and heating of ancient vegetation over geological time scales. According to this theory, it is formed from the decayed remains of prehistoric marine animals and terrestrial plants. Over many centuries this organic matter, mixed with mud, is buried under thick sedimentary layers of material. The resulting high levels of heat and pressure cause the remains to metamorphose, first into a waxy material known as kerogen, and then into liquid and gaseous hydrocarbons in a process known as catagenesis. These then migrate through adjacent rock layers until they become trapped underground in porous rocks called reservoirs, forming an oil field, from which the liquid can be extracted by drilling and pumping. 150 m is generally considered the "oil window". Though this corresponds to different depths for different locations around the world, a 'typical' depth for an oil window might be 4 - 5 km. Three conditions must be present for oil reservoirs to form: a rich source rock, a migration conduit, and a trap (seal) that forms the reservoir.

The reactions that produce oil and natural gas are often modeled as first order breakdown reactions, where kerogen breaks down to oil and natural gas by a large set of parallel reactions, and oil eventually breaks down to natural gas by another set of reactions.

Abiogenic theory

The idea of abiogenic petroleum origin was championed in the Western world by Thomas Gold based on thoughts from Russia, mainly on studies of Nikolai Kudryavtsev. The idea proposes that large amounts of carbon exist naturally in the planet, some in the form of hydrocarbons. Hydrocarbons are less dense than aqueous pore fluids, and migrate upward through deep fracture networks. Thermophilic, rock-dwelling microbial life-forms are in part responsible for the biomarkers found in petroleum.

This theory is very much a minority opinion amongst geologists. This theory often pops up when scientists are not able to explain apparent oil inflows into certain oil reservoirs. These instances are rare.

Extraction

Locating an oil field is the first obstacle to be overcome.

Today, petroleum engineers use instruments such as gravimeters and magnetometers

in the search for petroleum. Generally, the first stage in the extraction

of crude oil is to drill a well into the underground reservoir. Historically,

in the USA, some oil fields existed where the oil rose naturally to the

surface, but most of these fields have long since been depleted, except

for certain remote locations in Alaska. Often many wells (called multilateral

wells) are drilled into the same reservoir, to ensure that the extraction

rate will be economically viable. Also, some wells (secondary wells) may

be used to pump water, steam, acids or various gas mixtures into the reservoir

to raise or maintain the reservoir pressure, and so maintain an economic

extraction rate.

If the underground pressure in the oil reservoir is sufficient, then the

oil will be forced to the surface under this pressure. Gaseous fuels or

natural gas are usually present, which also supply needed underground

pressure. In this situation it is sufficient to place a complex arrangement

of valves (the Christmas tree) on the well head to connect the well to

a pipeline network for storage and processing. This is called primary

oil recovery. Usually, only about 20% of the oil in a reservoir can be

extracted this way.

Over the lifetime of the well the pressure will fall, and at some point

there will be insufficient underground pressure to force the oil to the

surface. If economical, and it often is, the remaining oil in the well

is extracted using secondary oil recovery methods (see: energy balance

and net energy gain). Secondary oil recovery uses various techniques to

aid in recovering oil from depleted or low-pressure reservoirs. Sometimes

pumps, such as beam pumps and electrical submersible pumps (ESPs), are

used to bring the oil to the surface. Other secondary recovery techniques

increase the reservoir's pressure by water injection, natural gas reinjection

and gas lift, which inject air, carbon dioxide or some other gas into

the reservoir. Together, primary and secondary recovery allows 25% to

35% of the reservoir's oil to be recovered.

Tertiary oil recovery reduces the oil's viscosity to increase oil production.

Tertiary recovery is started when secondary oil recovery techniques are

no longer enough to sustain production, but only when the oil can still

be extracted profitably. This depends on the cost of the extraction method

and the current price of crude oil. When prices are high, previously unprofitable

wells are brought back into production and when they are low, production

is curtailed. Thermally enhanced oil recovery methods (TEOR) are tertiary

recovery techniques that heat the oil and make it easier to extract.

Steam injection is the most common form of TEOR, and is often done with

a cogeneration plant. In this type of cogeneration plant, a gas turbine

is used to generate electricity and the waste heat is used to produce

steam, which is then injected into the reservoir. This form of recovery

is used extensively to increase oil production in the San Joaquin Valley,

which has very heavy oil, yet accounts for 10% of the United States' oil

production. In-situ burning is another form of TEOR, but instead of steam,

some of the oil is burned to heat the surrounding oil. Occasionally, detergents

are also used to decrease oil viscosity. Tertiary recovery allows another

5% to 15% of the reservoir's oil to be recovered.

Alternative Means of Producing Oil

As oil prices continue to escalate, other alternatives

to producing oil have been gaining importance. The most viable of these

is the coal to oil process, of which the most efficient is the Karrick

process, which converts coal into crude oil. Production has been estimated

to be work out at about $35 per barrel.

A less efficient methodology is the Fischer-Tropsch process. It was a

concept pioneered in Nazi Germany when imports of petroleum were restricted

due to war and Germany found a method to extract oil from coal. It was

known as Ersatz ("substitute" in German), and accounted for

nearly half the total oil used in WWII by Germany. However, the process

was used only as a last resort as naturally occurring oil was much cheaper.

As crude oil prices increase, the cost of coal to oil conversion becomes

comparatively cheaper.

The method involves converting high ash coal into synthetic oil in a multistage

process. Ideally, a ton of coal produces nearly 200 liters (1.25 bbl,

52 US gallons) of crude, with by-products ranging from tar to rare chemicals.

Currently, two companies have commercialized their Fischer-Tropsch technology.

Shell in Bintulu, Malaysia, uses natural gas as a feedstock, and produces

primarily low-sulfur diesel fuels. Sasol in South Africa uses coal as

a feedstock, and produces a variety of synthetic petroleum products. The

process is today used in South Africa to produce most of the country's

diesel fuel from coal by the company Sasol. The process was used in South

Africa to meet its energy needs during its isolation under Apartheid.

This process has received renewed attention in the quest to produce low

sulfur diesel fuel in order to minimize the environmental impact from

the use of diesel engines.

More recently explored is Thermal depolymerization (TDP). In theory, TDP

can convert any organic waste into petroleum.

History

The first oil wells were drilled in China in the 4th century

or earlier. They had depth of up to 243 meters and were drilled using

bits attached to bamboo poles. The oil was burned to evaporate brine and

produce salt. By the 10th century, extensive bamboo pipelines connected

oil wells with salt springs. Ancient Persian tablets indicate the medicinal

and lighting uses of petroleum in the upper echelons of their society.

In the 8th century, the streets of the newly-constructed Baghdad were

paved with tar, derived from easily-accessible petroleum from natural

fields in the region. In the 9th century, oil fields were exploited in

Baku, Azerbaijan, to produce naphtha. These fields were described by the

geographer Masudi in the 10th century, and by Marco Polo in the 13th century,

who described the output of those wells as hundreds of shiploads.

The modern history of petroleum began in 1846, with the discovery of the

process of refining kerosene from coal by Atlantic Canada's Abraham Pineo

Gesner. Poland's Ignacy Łukasiewicz discovered a means of refining kerosene

from the more readily available "rock oil" ("petr-oleum")

in 1852 and the first rock oil mine was built in Bobrka, near Krosno in

southern Poland in the following year. These discoveries rapidly spread

around the world, and Meerzoeff built the first Russian refinery in the

mature oil fields at Baku in 1861. At that time Baku produced about 90%

of the world's oil. The battle of Stalingrad was fought over Baku (now

the capital of the Azerbaijan Republic).

The first commercial oil well drilled in North America was in Oil Springs,

Ontario, Canada in 1858, dug by James Miller Williams. The American petroleum

industry began with Edwin Drake's discovery of oil in 1859, near Titusville,

Pennsylvania. The industry grew slowly in the 1800s, driven by the demand

for kerosene and oil lamps. It became a major national concern in the

early part of the 20th century; the introduction of the internal combustion

engine provided a demand that has largely sustained the industry to this

day. Early "local" finds like those in Pennsylvania and Ontario

were quickly exhausted, leading to "oil booms" in Texas, Oklahoma,

and California.

By 1910, significant oil fields had been discovered in Canada (specifically,

in the province of Alberta), the Dutch East Indies (1885, in Sumatra),

Persia (1908, in Masjed Soleiman), Peru, Venezuela, and Mexico, and were

being developed at an industrial level.

Even until the mid-(1950s), coal was still the world's foremost fuel,

but oil quickly took over. Following the 1973 energy crisis and the 1979

energy crisis, there was significant media coverage of oil supply levels.

This brought to light the concern that oil is a limited resource that

will eventually run out, at least as an economically viable energy source.

At the time, the most common and popular predictions were always quite

dire, and when they did not come true, many dismissed all such discussion.

The future of petroleum as a fuel remains somewhat controversial. USA

Today news (2004) reports that there are 40 years of petroleum left in

the ground. Some would argue that because the total amount of petroleum

is finite, the dire predictions of the 1970s have merely been postponed.

Others argue that technology will continue to allow for the production

of cheap hydrocarbons and that the earth has vast sources of unconventional

petroleum reserves in the form of tar sands, bitumen fields and oil shale

that will allow for petroleum use to continue in the future, with both

the Canadian tar sands and United States shale oil deposits representing

potential reserves matching existing liquid petroleum deposits worldwide.

Today, about 90% of vehicular fuel needs are met by oil. Petroleum also

makes up 40% of total energy consumption in the United States, but is

responsible for only 2% of electricity generation. Petroleum's worth as

a portable, dense energy source powering the vast majority of vehicles

and as the base of many industrial chemicals makes it one of the world's

most important commodities. Access to it was a major factor in several

military conflicts, including World War II and the Persian Gulf War. About

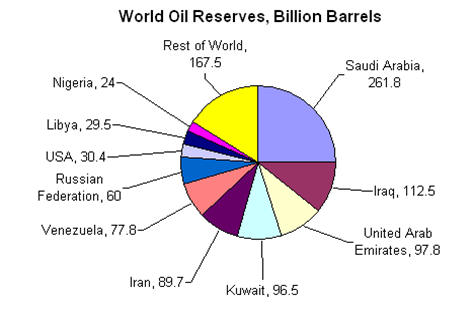

80% of the world's readily accessible reserves are located in the Middle

East, with 62.5% coming from the Arab 5: Saudi Arabia (12.5%), UAE, Iraq,

Qatar and Kuwait. The USA has less than 3%.

Environmental Effects

The presence of oil has significant social and environmental

impacts, from accidents and routine activities such as seismic exploration,

drilling, and generation of polluting wastes. Oil extraction is costly

and sometimes environmentally damaging, although Dr. John Hunt from Woods

Hole pointed out in a 1981 paper that over 70% of the reserves in the

world are associated with visible macro-seepages, and many oil fields

are found due to natural leaks. Offshore exploration and extraction of

oil disturbs the surrounding marine environment. Extraction may involve

dredging, which stirs up the seabed, killing the sea plants that marine

creatures need to survive. Crude oil and refined fuel spills from tanker

ship accidents have damaged fragile ecosystems in Alaska, the Galapagos

Islands, Spain, and many other places.

Burning oil releases carbon dioxide into the atmosphere, which contributes

to global warming. Per energy unit, oil produces less CO2 than coal, but

more than natural gas. However, oil's unique role as a transportation

fuel makes reducing its CO2 emissions a particularly thorny problem; amelioration

strategies such as carbon sequestering are generally geared for large

power plants, not individual vehicles.

Renewable energy source alternatives do exist, although the degree to

which they can replace petroleum and the possible environmental damage

they may cause are uncertain and controversial. Sun, wind, geothermal,

and other renewable electricity sources cannot directly replace high energy

density liquid petroleum for transportation use; instead automobiles and

other equipment must be altered to allow using electricity (in batteries)

or hydrogen (via fuel cells or internal combustion) which can be produced

from renewable sources. Other options include using biomass-origin liquid

fuels (ethanol, biodiesel). Any combination of solutions to replace petroleum

as a liquid transportation fuel will be a very large undertaking.

Classification

The oil industry classifies "crude" by the location

of its origin (e.g., "West Texas Intermediate, WTI" or "Brent")

and often by its relative weight (API gravity) or viscosity ("light",

"intermediate" or "heavy"); refiners may also refer

to it as "sweet", which means it contains relatively little

sulfur, or as "sour", which means it contains substantial amounts

of sulfur and requires more refining in order to meet current product

specifications.

The world reference barrels are:

- Brent Blend, comprising 15 oils from fields in the Brent and Ninian systems in the East Shetland Basin of the North Sea. The oil is landed at Sullom Voe terminal in the Shetlands. Oil production from Europe, Africa and Middle Eastern oil flowing West tends to be priced off the price of this oil, which forms a benchmark. See also Brent crude.

- West Texas Intermediate (WTI) for North American oil.

- Dubai, used as benchmark for Middle East oil flowing to the Asia-Pacific region.

- Tapis (from Malaysia, used as a reference for light Far East oil)

- Minas (from Indonesia, used as a reference for heavy Far East oil)

- The OPEC basket used to be the average price of the following blends:

a. Arab Light Saudi Arabia

b. Bonny Light Nigeria

c. Fateh Dubai

d. Isthmus Mexico (non-OPEC)

e. Minas Indonesia

f. Saharan Blend Algeria

g. Tia Juana Light Venezuela

In June 15, 2005 the OPEC basket was changed to reflect the characteristics of the oil produced by OPEC members. The new OPEC Reference Basket (ORB) is made up of the following: Saharan Blend (Algeria), Minas (Indonesia), Iran Heavy (Islamic Republic of Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Qatar Marine (Qatar), Arab Light (Saudi Arabia), Murban (UAE) and BCF 17 (Venezuela).

Uses:

The chemical structure of petroleum is composed of hydrocarbon chains

of different lengths. Because of this, petroleum may be taken to oil refineries

and the hydrocarbon chemicals separated by distillation and treated by

other chemical processes, to be used for a variety of purposes. See Petroleum

products.

- Ethane and other short-chain alkanes which are used as fuel

- Diesel fuel (petro-diesel)

- Fuel oils

- Gasoline

- Jet fuel

- Kerosene

- Liquid petroleum gas (LPG)

- Natural gas

Generally used in transportation, power

plants and heating.

Petroleum vehicles are internal combustion engine vehicles.

Other derivatives:

Certain types of resultant hydrocarbons may be mixed with other non-hydrocarbons,

to create other end products:

- Alkenes (olefins) which can be manufactured into plastics or other compounds

- Lubricants (produces light machine oils, motor oils, and greases, adding viscosity stabilizers as required).

- Wax, used in the packaging of frozen foods, among others.

- Sulfur or Sulfuric acid. These are a useful industrial materials. Sulfuric acid is usually prepared as the acid precursor oleum, a by-product of sulfur removal from fuels.

- Bulk tar.

- Asphalt

- Petroleum coke, used in specialty carbon products or as solid fuel.

- Paraffin wax

- Aromatic petrochemicals to be used as precursors in other chemical production.

References to the oil prices are usually either references to the spot price of either WTI/Light Crude as traded on New York Mercantile Exchange (NYMEX) for delivery in Cushing, Oklahoma; or the price of Brent as traded on the International Commodities Exchange (ICE, which the International Petroleum Exchange has been incorporated into) for delivery at Sullom Voe. The price of a barrel of oil is highly dependent on both its grade (which is determined by factors such as its specific gravity or API and its Sulphur content) and location. The vast majority of oil will not be traded on an exchange but on a over-the-counter basis, typically with reference to a marker crude oil grade that is typically quoted via pricing agencies such as Argus Media Ltd and Platts. For example in Europe a particular grade of oil, say Fulmar, might be sold at a price of "Brent plus US$0.25/barrel" or as an intra-company transaction. IPE claim that 65% of traded oil is priced off their Brent benchmarks. Other important benchmarks include Dubai, Tapis, and the OPEC basket. The Energy Information Administration (EIA) uses the Imported Refiner Acquisition Cost, the weighted average cost of all oil imported into the US as their "world oil price".

It is often claimed that OPEC sets the oil price and the true cost of a barrel of oil is around $2, which is equivalent to the cost of extraction of a barrel in the Middle East. These estimates of costs ignore the cost of finding and developing oil reserves. Furthermore the important cost as far as price is concerned, is not the price of the cheapest barrel but the cost of producing the marginal barrel. By limiting production OPEC has caused more expensive areas of production such as the North Sea to be developed before the Middle East has been exhausted. OPEC's power is also often overstated. Investing in spare capacity is expensive and the low oil price environment in the late 90s led to cutbacks in investment. This has meant during oil price rallies, OPEC's spare capacity has not been sufficient to stabilize prices.

Oil demand is highly dependent on global macroeconomic conditions, so this is also an important determinant of price. Some economists claim that high oil prices have a large negative impact on the global growth. This means that the relationship between the oil price and global growth is not particularly stable although a high oil price is often thought of as being a late cycle phenomenon.

The most recent low point was reached in January 1999, after increased oil production from Iraq coincided with the Asian financial crisis, which reduced demand. The prices then rapidly increased, more than doubling by September 2000, then fell until the end of 2001 before steadily increasing, reaching US $40 to US $50 per barrel by September 2004. In October 2004, light crude futures contracts on the NYMEX for November delivery exceeded US $53 per barrel and for December delivery exceeded US $55 per barrel. Crude oil prices surged to record highs above $85 a barrel in October 2007, sustaining a rally built on strong demand for gasoline and diesel and on concerns about refiners' ability to keep up.

The New York Mercantile Exchange (NYMEX) trades crude oil (including futures contracts) and provides the basis of US crude oil pricing via WTI (West Texas Intermediate). Other exchanges also trade crude oil futures, e.g. the International Commodities Exchange (ICE) in London trades contracts in Brent crude. Even individuals can now trade crude oil through online trading sites margin account or their banks through structured products indexed on the Commodities markets.

Top Petroleum-Producing Countries

| In order of amount produced in 2007 | (MMbbl/d = millions of barrels per day) | In order of amount exported in 2007 |

| Saudi Arabia (OPEC) | 10.37 MMbbl/d | Saudi Arabia (OPEC) |

| Russia | 09.27 MMbbl/d | Russia |

| United States | 18.69 MMbbl/d | Norway |

| Iran (OPEC) | 04.09 MMbbl/d | Iran (OPEC) |

| Mexico | 13.83 MMbbl/d | United Arab Emirates (OPEC) |

| China | 13.62 MMbbl/d | Venezuela (OPEC) |

| Norway | 13.18 MMbbl/d | Kuwait (OPEC) |

| Canada | 13.14 MMbbl/d | Nigeria (OPEC) |

| Venezuela (OPEC) | 12.86 MMbbl/d | Mexico |

| United Arab Emirates (OPEC) | 02.76 MMbbl/d | Algeria (OPEC) |

| Kuwait (OPEC) | 02.51 MMbbl/d | Libya (OPEC) |

| Nigeria (OPEC) | 02.51 MMbbl/d | |

| United Kingdom | 12.08 MMbbl/d | |

| Iraq (OPEC) | 22.03 MMbbl/d | |

| *Peak production already passed in this state. | *Though still a member, Iraq has not been included in production figures since 1998. | * Note that the USA consumes almost

all of its own production, whilst the UK has recently become a net-importer

rather than net-exporter. * Total world production/consumption (as of 2006) is approximately 84 million barrels per day. |

Typical Light,

Sweet Crude Oil Contract Specification

Futures: 1,000 U.S. barrels (42,000 gallons).

Options: One NYMEX Division light, sweet crude oil futures contract.

Price Quotation

Futures and Options: Dollars and cents per barrel.

Trading Hours

Futures and Options: Open outcry trading is conducted from 10:00 A.M.

till 2:30 P.M.

After hours futures trading are conducted via the NYMEX ACCESS® internet-based

trading platform beginning at 3:15 P.M. on Mondays through Thursdays and

concluding at 9:30 A.M. the following day. On Sundays, the session begins

at 7:00 P.M. All times is New York time.

Trading Months

Futures: 30 consecutive months plus long-dated futures initially listed

36, 48, 60, 72, and 84 months prior to delivery.

Additionally, trading can be executed at an average differential to the

previous day's settlement prices for periods of two to 30 consecutive

months in a single transaction. These calendar strips are executed during

open outcry trading hours.

Options: 12 consecutive months, plus three long-dated options at 18, 24,

and 36 months out on a June/December cycle.

Minimum Price Fluctuation

Futures and Options: $0.01 (1¢) per barrel ($10.00 per contract).

Maximum Daily Price Fluctuation

Futures: $10.00 per barrel ($10,000 per contract) for all months. If any

contract is traded, bid, or offered at the limit for five minutes, trading

is halted for five minutes. When trading resumes, the limit is expanded

by $10.00 per barrel in either direction. If another halt were triggered,

the market would continue to be expanded by $10.00 per barrel in either

direction after each successive five-minute trading halt. There will be

no maximum price fluctuation limits during any one trading session.

Options: No price limits.

Last Trading Day

Futures: Trading terminates at the close of business on the third business

day prior to the 25th calendar day of the month preceding the delivery

month. If the 25th calendar day of the month is a non-business day, trading

shall cease on the third business day prior to the last business day preceding

the 25th calendar day.

Options: Trading ends three business days before the underlying futures

contract.

Exercise of Options

By a clearing member to the Exchange clearinghouse not later than 5:30

P.M., or 45 minutes after the underlying futures settlement price is posted,

whichever is later, on any day up to and including the option's expiration.

Options Strike Prices

Twenty strike prices in increments of $0.50 (50¢) per barrel above and

below the at-the-money strike price, and the next ten strike prices in

increments of $2.50 above the highest and below the lowest existing strike

prices for a total of at least 61 strike prices. The at-the-money strike

price is nearest to the previous day's close of the underlying futures

contract. Strike price boundaries are adjusted according to the futures

price movements.

Delivery

F.O.B. seller's facility, Cushing, Oklahoma, at any pipeline or storage

facility with pipeline access to TEPPCO, Cushing storage, or Equilon Pipeline

Co., by in-tank transfer, in-line transfer, book-out, or inter-facility

transfer (pumpover).

Delivery Period

All deliveries are rateable over the course of the month and must be initiated

on or after the first calendar day and completed by the last calendar

day of the delivery month.

Alternate Delivery Procedure

(ADP)

An alternate delivery procedure is available to buyers and sellers who

have been matched by the Exchange subsequent to the termination of trading

in the spot month contract. If buyer and seller agree to consummate delivery

under terms different from those prescribed in the contract specifications,

they may proceed on that basis after submitting a notice of their intention

to the Exchange.

Exchange of Futures for,

or in Connection with, Physicals (EFP)

The commercial buyer or seller may exchange a futures position for a physical

position of equal quantity by submitting a notice to the Exchange. EFPs

may be used to either initiate or liquidate a futures position.

Deliverable Grades

Specific domestic crudes with 0.42% sulfur by weight or less, not less

than 37° API gravity or more than 42° API gravity. The following domestic

crude streams are deliverable: West Texas Intermediate, Low Sweet Mix,

New Mexican Sweet, North Texas Sweet, Oklahoma Sweet, South Texas Sweet.

Specific foreign crude of not less than 34° API nor more than 42° API.

The following foreign streams are deliverable: U.K. Brent and Forties,

and Norwegian Oseberg Blend, for which the seller shall receive a 30¢-per-barrel

discount below the final settlement price; Nigerian Bonny Light and Colombian

Cusiana are delivered at 15¢ premiums; and Nigerian Qua Iboe is delivered

at a 5¢ premium.

Inspection

Inspection shall be conducted in accordance with pipeline practices. A

buyer or seller may appoint an inspector to inspect the quality of oil

delivered. However, the buyer or seller who requests the inspection will

bear its costs and will notify the other party of the transaction that

the inspection will occur.

Position Accountability

Limits

Any one month/all months: 20,000 net futures, but not to exceed 1,000

in the last three days of trading in the spot month.

Margin Requirements

Margins are required for open futures or short options positions. The

margin requirement for an options purchaser will never exceed the premium.

Trading Symbols

Futures: CL

Options: LO

Futures and Options Trading involve risk of loss and is not suitable for everyone. Options, cash & futures markets are separate and distinct and do not necessarily respond in the same way to similar market stimulus. A movement in the cash market would not necessarily move in tandem with the related futures & options contract being offered.

Copyright © 2007 - 2022

ARABCCI, All rights reserved | جميع الحقوق محفوظة | 不得轉載 | Disclaimer | Site Map